Q4 2020 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact any of our team members at Team Abolafia!

REGIONAL ECONOMIC OVERVIEW

After the COVID-19-induced declines, employment levels in Western Washington continue to rebuild. Interestingly, the state re-benchmarked employment numbers, which showed that the region lost fewer jobs than originally reported. That said, regional employment is still 133,000 jobs lower than during the 2020 peak in February. The return of jobs will continue, but much depends on new COVID-19 infection rates and when the Governor can reopen sections of the economy that are still shut down. Unemployment levels also continue to improve. At the end of the quarter, the unemployment rate was a very respectable 5.5%, down from the peak rate of 16.6% in April. The rate varies across Western Washington, with a low of 4.3% in King County and a high of 9.6% in Grays Harbor County. My current forecast calls for employment levels to continue to improve as we move through the spring. More robust growth won’t happen until a vaccine becomes widely distributed, which is unlikely to happen before the summer.

WESTERN WASHINGTON HOME SALES

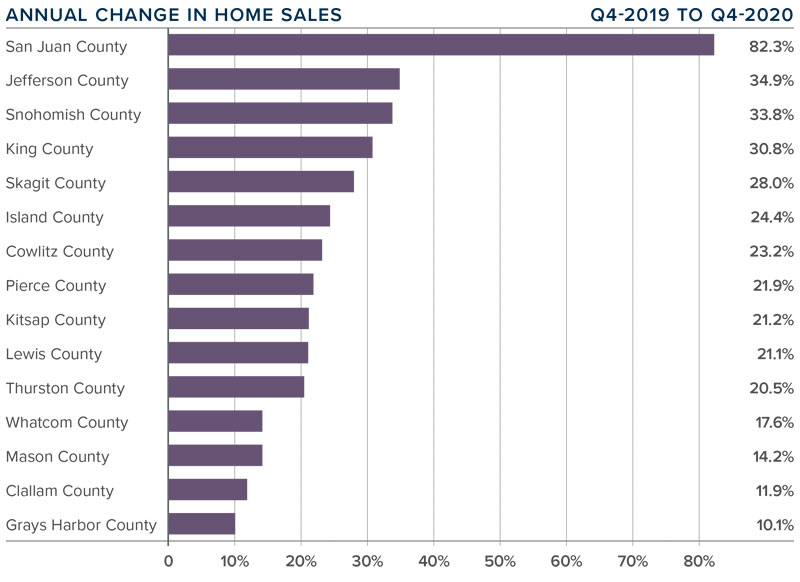

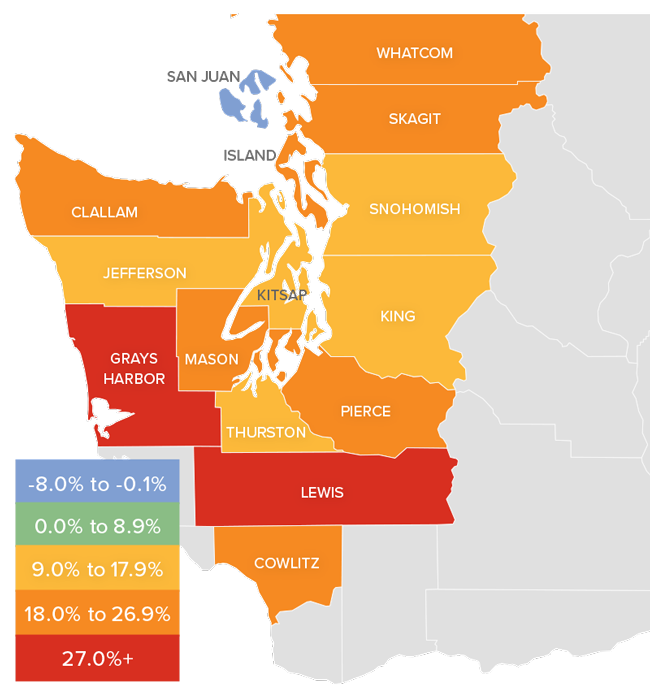

❱ Sales continued to impress, with 23,357 transactions in the quarter. This was an increase of 26.6% from the same period in 2019, but 8.3% lower than in the third quarter of last year, likely due to seasonality.

❱ Listing activity remained very low, even given seasonality. Total available inventory was 37.3% lower than a year ago and 31.2% lower than in the third quarter of 2020.

❱ Sales rose in all counties, with San Juan County seeing the greatest increase. This makes me wonder if buyers are actively looking in more remote markets given ongoing COVID-19 related concerns.

❱ Pending sales—a good gauge of future closings—were 25% higher than a year ago but down 31% compared to the third quarter of 2020. This is unsurprising, given limited inventory and seasonal factors.

WESTERN WASHINGTON HOME PRICES

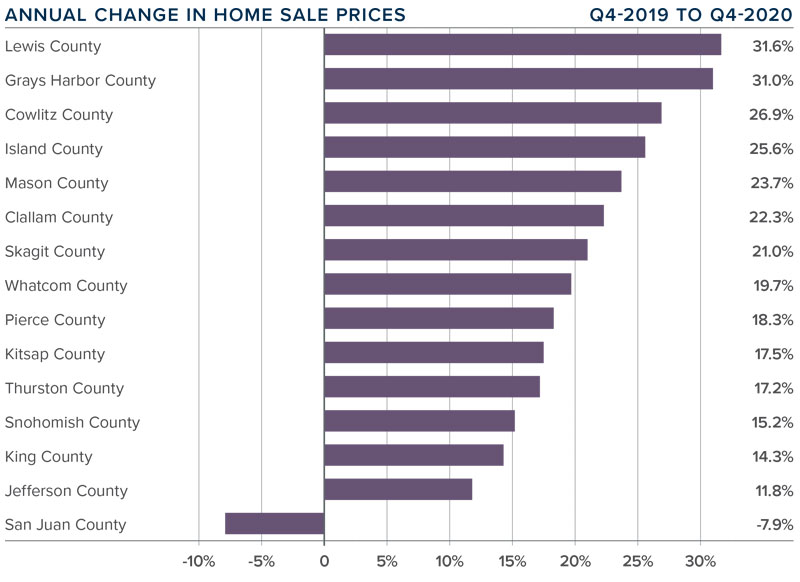

❱ Home price growth in Western Washington continued the trend of above-average appreciation. Prices were up 17.4% compared to a year ago, with an average sale price of $617,475.

❱ Year-over year price growth was strongest in Lewis and Grays Harbor counties. Home prices declined in San Juan County which is notoriously volatile because of its small size.

❱ It is interesting to note that home prices were only 1% higher than third quarter of 2020. Even as mortgage rates continued to drop during the quarter, price growth slowed, and we may well be hitting an affordability ceiling in some markets.

❱ Mortgage rates will stay competitive as we move through 2021, but I expect to see price growth moderate as we run into affordability issues, especially in the more expensive counties.

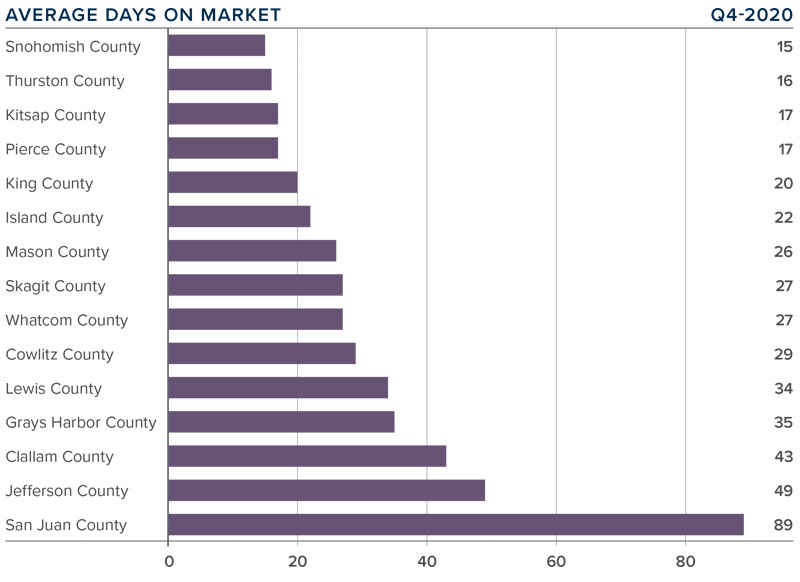

DAYS ON MARKET

❱ 2020 ended with a flourish as the average number of days it took to sell a home in the final quarter dropped by a very significant 16 days compared to a year ago.

❱ Snohomish County was again the tightest market in Western Washington, with homes taking an average of only 15 days to sell. The only county that saw the length of time it took to sell a home rise compared to the same period a year ago was small Jefferson County, but it was only an increase of four days.

❱ Across the region, it took an average of 31 days to sell a home in the quarter. It is also worth noting that, even as we entered the winter months, it took an average of five fewer days to sell a home than in the third quarter of last year.

❱ The takeaway here is that demand clearly remains strong, and competition for the few homes available to buy continues to push days on market lower.

CONCLUSIONS

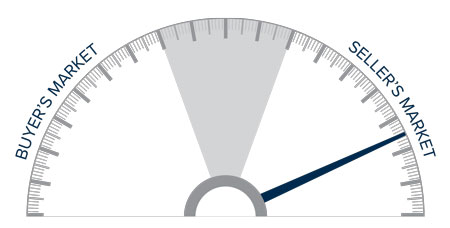

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

2021 is likely to lead more homeowners to choose to move if they can work from home, which will continue to drive sales growth and should also lead to more inventory. That said, affordability concerns in markets close to Western Washington’s job centers, in combination with modestly rising mortgage rates, should slow the rapid home price appreciation we have seen for several years. I, for one, think that is a good thing.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

REGIONAL ECONOMIC OVERVIEW

Employment numbers in Western Washington continue to improve following the massive decline caused by COVID-19. For perspective, the area shed more than 373,000 jobs between February and April. However, the recovery has been fairly robust: almost 210,000 of those jobs have returned. Unemployment levels remain elevated; the current rate is 8.2%. That said, it is down from 16.6% in April. The rate, of course, varies across Western Washington counties, with a current low of 7.2% in King County and a high of 11.2% in Grays Harbor County. The economy is healing, but the pace of improvement has slowed somewhat, which is to be expected. That said, I anticipate that jobs will continue to return as long as we do not see another spike in new infections.

HOME SALES

- Sales continued to improve following the COVID-19-related drop in the first quarter of the year. There were 25,477 transactions in the quarter, an increase of 11.6% from the same period in 2019, and 45.9% higher than in the second quarter of this year.

- Listing activity remains woefully inadequate, with total available inventory 41.7% lower than a year ago, but 1.6% higher than in the second quarter of this year.

- Sales rose in all but two counties, though the declines were minimal. The greatest increase in sales was in San Juan County, which leads one to wonder if buyers are actively looking in more isolated markets given ongoing COVID-19-related concerns.

- Pending sales—a good gauge of future closings—rose 29% compared to the second quarter of the year, suggesting that fourth quarter closings will be positive.

HOME PRICES

- Home-price growth in Western Washington rose a remarkable 17.1% compared to a year ago. The average sale price was $611,793.

- When compared to the same period a year ago, price growth was strongest in Mason, Island, and San Juan counties. Only one county saw prices rise by less than ten percent.

- It was even more impressive to see the region’s home prices up by a very significant 9.4% compared to the second quarter of 2020. It is clear that low mortgage rates, combined with limited inventory, are pushing prices up.

- As long as mortgage rates stay low, and there isn’t an excessive spike in supply (which is highly unlikely), prices will continue to rise at above-average rates. That said, if this continues for too long, we will start to face affordability issues in many markets.

DAYS ON MARKET

- The average number of days it took to sell a home in the third quarter of this year dropped two days compared to a year ago.

- Snohomish County was the tightest market in Western Washington, with homes taking an average of only 16 days to sell. All but two counties—Lewis and San Juan—saw the length of time it took to sell a home rise compared to the same period a year ago.

- Across the region, it took an average of 36 days to sell a home in the quarter. It is also worth noting that it took an average of 4 fewer days to sell a home than in the second quarter of this year.

- The takeaway here is that significant increases in demand, in concert with remarkably low levels of inventory, continue to drive market time lower.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

High demand, favorable interest rates, and low supply clearly point to a seller’s market in Western Washington. As such, I am moving the needle even more in favor of sellers.

As I suggested earlier in this report, although the market is remarkably buoyant, I am starting to see affordability issues increase in many areas—not just in the central Puget Sound region—and this is concerning. Perhaps the winter will act to cool the market, but something is telling me we shouldn’t count on it.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link